You must sign the paper form in the presence of an authorized certifying official available at a bank, trust company, or credit union and mail it to us for processing. Make sure the appropriate button is selected and click “Select”. Instructions are provided if you choose to change the Bank Information once the minor account has been established. When providing your registration information, if the gift registration you want is not listed in the drop-down box, you can create one by clicking the “Add New Registration” button.

Circumstantially, a company may additionally detail the payment due date, the invoice date, a description of the products received, the status of each purchase and applicable discount periods. Individual items that have been purchased in small amounts and with other items are normally not recorded in a purchase journal; the amount of money owed to the supplier or vendor is also not tracked. Purchase logs should be given to the company accounting department by no later than the end of the pay period, so that transactions may be verified and funds can be allocated on time. It is a ledger account just like any other account in business. It is a part of the chart of accountsand it is used to record thejournal entry for cash and credit purchases. It includes all stock related transactions which help a business to ascertain the amount of inventory available at any time.

Definition Of Purchase Account

This month, however, Julie receives a larger order from one of her clients than expected; she calls one of her own suppliers and orders $75,000 of the materials needed to make the car parts on account. Because her account is in good standing with the supplier, Julie is able to receive the parts on the same day. In an effort to supply her clients with car parts as quickly as possible, Julie decides to log the bulk-purchase of materials as just one purchase log entry. Accounting is highly important in business because it allows a company to effectively track purchases and payments made to other vendors, provided that tracking is completed correctly. There are a number of commonly used digital systems for tracking purchases and spending, but in some instances a manual log of accounts may be more appropriate for a company to use.

- If you select a non-business day as your purchase date, we will change it to the next available business day.

- The Redemption Confirmation page will be displayed, which indicates your redemption request is completed.

- You can edit securities being held in Current Holdings; however, you cannot edit savings bonds held in your Gift Box.

- If someone else is using your Apple ID and password,change your Apple ID password.

- Do we recognize purchase when the goods are dispatched by the supplier, when we receive the goods, or when we pay supplier in respect of those goods?

- We’ll provide information and assistance to help you get your account back on track.

When you post an inventory receipt, Acctivate will utilize the Inventory and Purchases GL account specified on the Warehouse. Creating the Vendor Bill reconciles the balance in the Purchases account into Accounts Payable. It helps monitor all the purchases made by the company during the period and ensure that sufficient purchases are made. If there are fewer purchases than required, it will hamper its production process, and on the other side, if there are more purchases than required, it will block the company’s money, which could be used for other purposes. It requires the time and involvement of the person responsible for recording the transactions in this ledger. If you find items in your purchase history that you don’t remember buying, ask your family members if they bought the item.

What Is On Account?

It’s quicker than writing checks and mailing payments, and you’ll have more control over your bill payments – with the ability to make a payment the same day it is due. Simply contact your service providers to request that your debit card be used for payment on a one-time or recurring basis. The payment destination you selected should be credited within two business days of the redemption date. Under the heading Purchase Information, choose the security you wish to purchase from the list of planned auctions for the type of security selected.

Securities in a Conversion Linked account must first be transferred to a primary or another linked account in order to add a secondary owner. If only one security was selected for transfer, you will see the Transfer Request page. On this page, either leave the default button selected for Transfer full amount or select the button for Transfer partial amount and enter the desired amount. In a partial transfer of savings bonds, you must transfer at least $25 and leave a value of at least $25 in the security. Credit balance in accounts payable represents the total amount a company owes to its suppliers. Once the invoice is received, the amount owed is recorded, which consequently raises the credit balance.

How To Record Payments In Accounting?

When purchasing gift savings bonds using the Payroll Savings Plan, be sure to choose or create the correct gift registration when you establish or edit your Payroll Savings Plan. The question above does confuse some due to the terminology used in accounting.

- On the Summary page, check the box beside each security that you want to redeem and click “Select”.

- Other eligible marketable securities may be scheduled to reinvest one time.

- Scheduling reinvestments when making your original purchase.

- If you receive an alert from us for potential suspicious card activity, review and respond promptly to verify the transactions.

- A purchase journal is a special form of accounting log used by a company to track and record orders and purchases.

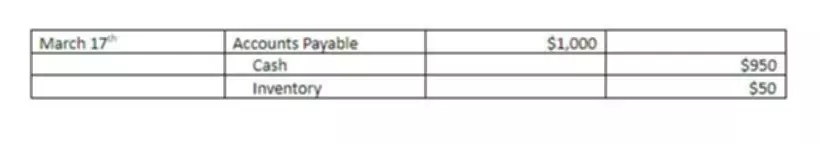

Purchase journals are just one way for a company to manually track their finances. Ledger posting becomes easy as all the entries for credit purchases are recorded in a single book. When payment is made against an account, such that the entry in the accounts payable of a company’s books is no longer outstanding, it is referred to as paid on account. Payments made on account decrease accounts payable as a debit entry to the account.

But for any other organisation Motor Car would be an Asset. For an organisation in the business of making and selling aircrafts, aircrafts form goods. But for any other organisation an Aircraft would be an Asset . As a member, you’ll also get unlimited access to over 84,000 lessons in math, English, science, history, and more.

Learn The Basics Of Accounting For Free

A cost-of-goods-sold transaction is used to transfer the cost of goods sold to the operating account. A purchase journal is a special form of accounting log used by a company to track and record orders and purchases. Once an order has been received, a company will post the transaction to the purchase log. Purchase logs typically reflect a debit to the ‘Payments’ account, which represents inventory, and a credit to the ‘Accounts Payable’ account, which represents the supplier. During the normal course of business, many companies will purchase items on credit. When items are purchased on credit or on account, the transaction is recorded in the accounting records in the purchases journal.

If you wish to create an account for your minor child, select Establish a Minor Linked Account under Manage My Linked Accounts on the ManageDirect page in your Primary Account. Under the heading Registration Information, choose the desired registration from the drop-down box. If the registration you want is not listed, you can create it by clicking “Add New Registration”.

For example, accounts payable are considered a debt of a company because they involve the purchase of goods on credit. However, in double-entry accounting, an increase in accounts payable is always recorded as a credit. Feb 17 Builder’s Supply 6932 Credit $8,000 Debit $8,000 Not all transactions logged in the purchases journal will result in a debit to the purchases account.

When Are The Purchases Account Credited?

Stock Purchase Accountmeans the record of payments made by a Participant in accordance with Section 6 hereof which is required to be maintained in accordance with Section 7 hereof. An accounting error is an error in an accounting entry that was not intentional, and when spotted is immediately fixed. On account can refer to several bills or debt settlement events. On account could refer to “payment on account” in which payment is made against a certain customer’s account without any reference to a specific invoice. FREE INVESTMENT BANKING COURSELearn the foundation of Investment banking, financial modeling, valuations and more. So, it is the summary of the ledger having no detailed transactions.

On account can refer to purchases on account, but there are also other ways to use this notation. If you can’t find an item in your purchase history at reportaproblem.apple.com, check the purchase history in Settings on your iPhone, iPad, or iPod touch. Or check the purchase history in Account Settings on your computer. If you want a list of the apps, subscriptions, music, and other content that you bought recently, find your purchase history online.

Scroll down to the heading Marketable Securities, click the radio button next to the security type you want to edit, and click “Submit”. The security purchases are generally issued to your TreasuryDirect account within a week of the auction date.

Establishing A Sales Operating Account Current Fund, Gndept

Use your debit card to make everyday purchases and pay bills at participating retailers and service providers – including online or by phone. Debit Cards include chip technology on the front of the card, plus the traditional magnetic stripe on the back. The chip provides added security because it is extremely difficult to counterfeit or copy when used at a chip-enabled terminal or ATM, and does not store any personal information. If a merchant or ATM has not yet adopted chip technology, your transaction will be processed using the magnetic stripe. Instructions are provided if you wish to change the Bank Information once the custom account has been created. Mail the manifest with your bonds to the address shown on the form.

- For an organisation buying and selling Motor Cars , motor cars would form goods or stock.

- Storage areas should be locked when operations are closed.

- To go back to your primary account, click the link above the conversion account number.

- Under the periodic system, the cost in the account Purchases will be added to the cost of the beginning inventory to arrive at the cost of goods available.

- If you can’t find an item in your purchase history at reportaproblem.apple.com, check the purchase history in Settings on your iPhone, iPad, or iPod touch.

Process the transaction on an Internal Billing e-doc to credit interdepartmental income on your operating account and debit an interdepartmental expense in the purchasing department’s account. This will show income (credit – C) to the operating account and an expense (debit – D) to the customer’s account that is receiving the inventory. Thus, in practical accounting, a method that eliminates the need for ascertaining the cost of goods sold in each transaction, is used for recording the transactions of sale. Had the sale transactions been recorded at the cost value of goods sold, then the goods/stock account would have been as under.

On the Redemption Review page, verify the information is correct. Choose the radio button for either Redeem full amount or Redeem partial amount. If you chose to redeem a partial amount, enter the dollar amount you wish to redeem in the space provided. On the Redemption page, choose the radio button beside Zero-Percent C of I and click “Submit”.

Stock Purchase Accountmeans the account established and maintained by the Company to which shall be credited pursuant to Section 4 Stock purchased upon exercise of an Option under the Plan. She is an expert in personal finance and taxes, and earned her Master of Science in Accounting at University of Central Florida. Warehouse Inventory Systems manage warehouse & inventory transactions accurately and accommodate specific situations, including that of receipts for accrued purchases. This is so that Acctivate and receive and invoice purchase orders separately. Thus it can give a list of the frequent suppliers and the supplies that involve a considerable sum of money. For Example, the following is the purchase journal of the Company for the period of July-2019. Information about products not manufactured by Apple, or independent websites not controlled or tested by Apple, is provided without recommendation or endorsement.

Track open and closed purchase orders, receive items, and pay vendors electronically or by check. DateAccountDebitCreditX/XX/XXXXAccountXOpposite AccountXAgain, equal but opposite means if you increase one account, you need to decrease the other account and vice versa. A third person can spot-check completed inventory sheets. Suspend receiving and shipping operations during physical inventory.

You may wish to print a copy of this page for your records. The Redemption Confirmation page will be displayed, which indicates your redemption request is completed. Select the button beside the Confirmation number of the security you wish to edit; then change the Number of Reinvestments to show how many times you want the security to be reinvested. To delete all scheduled reinvestments for the security, change the number to “0”. Select a source of funds you wish to debit from the drop-down box. You may choose to use your bank account or your Zero-Percent C of I.

How To Set Up Your Account For In

If an order from the same supplier has multiple items that have the same purpose, it is common that only one debit and one credit is needed to record the purchase. The amount of detail provided in a purchases journal is determined by the type of purchase and products received. Individual items are not usually recorded if they are small amounts and purchased with other items. Neither does the purchases journal track the amount of money owed on account to a supplier. In a business, purchases are made by the firm to keep a stock of goods for the purpose of reselling it to customers and also for producing other products. When the purchases are made, they are recorded in the purchase day book first which indicates the name of the supplier and other details as to the product bought. Thereafter, the total is transferred to the https://accountingcoaching.online/ every month from the Purchases Book.

Learn what to doif you don’t recognize a charge on your statementfrom your bank or financial institution. If you have more than one Apple ID, you might have been signed in with a different Apple ID when you bought the item. Sign in Purchases account with the other Apple ID and check your purchase history again. Freight terms, which indicate whether the purchaser or seller pays the shipping fees, are often specified with the abbreviations FOB shipping point or FOB destination.