Increase your desired income on your desired schedule by using Taxfyle’s platform to pick up tax filing, consultation, and bookkeeping jobs. Taxes are incredibly complex, so we may not have been able to answer your question in the article. Get $30 off a tax consultation with a licensed CPA or EA, and we’ll be sure to provide you with a robust, bespoke answer to whatever tax problems you may have.

- It further includes initial paid-up capital and additional paid-up capital.

- In this article, we will explore the definition, purpose, components, and advantages of using a classified balance sheet.

- Banks, lenders, and other institutions may calculate financial ratios off of the balance sheet balances to gauge how much risk a company carries, how liquid its assets are, and how likely the company will remain solvent.

- Current assets include resources that are consumed or used in the current period.

- This helps us see what the company uses every day, like cash or products to sell, which are called current assets.

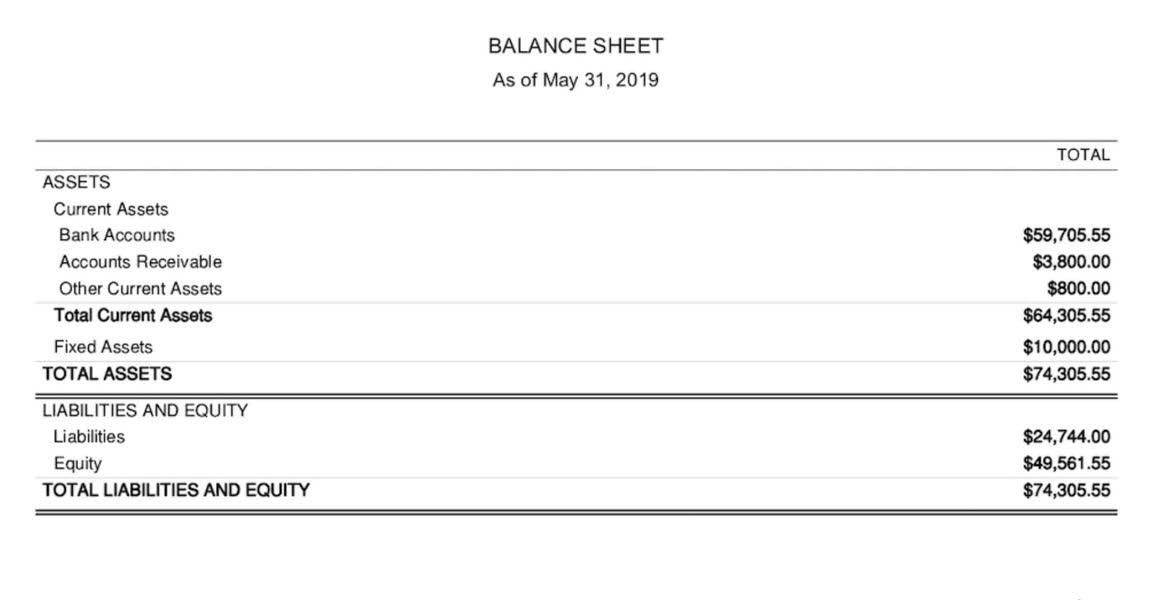

Stated differently, every asset has a claim against it—by creditors and/or owners. The balance sheet shows us what the firm has (its assets), who owns them (equity), and who the firm owes (its liabilities). Clear Lake Sporting Goods has cash, accounts receivable, inventory, short-term investments, and equipment. It rents its facilities, so it has no buildings on its balance sheets. The assets section for Clear Lake’s classified balance sheet is shown in Figure 5.7. In our classified balance sheet, we make sure to list total assets, total liabilities, and total shareholders’ equity clearly.

Current Liabilities

If they were created within the company, then they are not allowed on the balance sheet per the rules established by the Financial Accounting Standards Board and the International Accounting Standards Board. Preparing a classified balance sheet requires careful attention to detail and a thorough understanding of accounting principles. By following a structured approach and addressing common classification challenges with informed strategies, you can enhance the accuracy and usefulness of the balance sheet. This meticulous preparation supports effective financial analysis, aiding stakeholders in making well-informed decisions based on a clear understanding of the company’s financial position. By segregating liabilities into current and non-current, a classified balance sheet presents a comprehensive view of a company’s financial obligations.

As opposed to an income statement which reports financial information over a period of time, a balance sheet is used to determine the health of a company on a specific day. The financial statement only captures the financial position of a company on a specific day. Looking at a single balance sheet by itself may make it difficult to extract whether a company is performing well. For example, imagine a company reports $1,000,000 of cash on hand at the end of the month.

Long Term Liabilities

Let’s walk through each one of these sections and answer the question what is a classified balance sheet. Manage your living expenses online with this free Household Budget Template. Track your company budget in a free all-in-one online workspace. Create a budget for your business startup in minutes with our free online spreadsheet. Track your weekly expenses with this free online budget spreadsheet. Keep your vacation budget with a free online Vacation Budget Planner Template.